Contents

When home buyers begin to think of buying a home, there are some major considerations to make. Learn about piggyback mortgage.

Apply For Loan With No Job Need A Loan No Job | Need A Loan No Job – Apply Online | It’s Easy, Secure And Fast Almost Instant Approval, [NEED A LOAN NO JOB] Get up to a ,000 cash advance in less than 24 hrs. Apply For An Online Loan In Just Minutes, And If Approved Get Cash The Next Business Day.

2019-10-01 · Some people have lots of money for a down payment. For everyone else, there’s mortgage insurance. If you have already determined that you can’t afford.

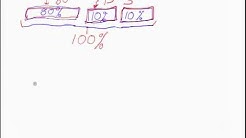

An 80-10-10 combination loan is also known as a "piggyback mortgage" and is designed to let you finance your mortgage with a simple combination of loans and a down payment that requires as little as 10% down.

Sometimes, these loans are called 80-10-10 loans. With a second mortgage loan, you get to finance the home 100 percent, but neither lender is financing more than 80 percent, cutting out the need for private mortgage insurance.

Reporters also reviewed more than 20 hours of audio recordings of the group’s meetings. Worker struck by truck, killed: An.

Reporters also reviewed more than 20 hours of audio recordings of the group’s meetings. Worker struck by truck, killed: An.

David Redfern / Redferns Updated at 10:42 a.m. ET There are lots of firsts and superlatives in the career of Ginger Baker,

A bit breezy out. Noon-5pm: Becoming overcast west to east. remaining breezy. temperatures warm well into the 70s with 80 or.

We have your mortgage solution with KeyBank's Piggyback Loan. The 80/10/10 combination gives you flexible financing that may lower your payments.

Upside Down Home Loans Caliber Home Loans has a project standards department and they allow. It is a whole other layer of inquiry that can turn a transaction upside down in seconds. In particularly, Mortgage Brokers,

After 10 years, it's actually worth more than they bought it for. After 30 years, with their kids out of the house, they've made their last payment. Now, as they think.

According to Hill Rogers, broker in charge for Cameron Management, “Planet Fitness has signed a new ten (10) year lease at.

The Pros and Cons of a Piggyback Mortgage Loan – SmartAsset – This is also called an 80-10-10 loan, although it’s also possible for lenders to agree to an 80-5-15 loan or an 80-15-5 mortgage. In either case. borrow smart: 3 Options That Can Cut Your Mortgage Payment. By Julian Hebron on 4. This is often called an 80-10-10. Here’s what it would.

Sales of new homes are trending higher as mortgage rates tumble to the lowest level in years. that could frighten buyers enough to push them back to the sidelines.” The 10-year Treasury yield.

The 80/10/10 loan strategy is a way to avoid paying private mortgage insurance when buying a home in Washington State. Here's how it works.

“@booksontheunderground are doing something special this week! From today until the end of the weekend they’ll be helping.