Contents

Usda Home Loans Map USDA Home Loan Map Changes 2018. In addition to borrower qualifications, we also need for the home to be in the USDA Home Loan footprint. usda sets the guidelines of what they estimate a RURAL area to be. Look at this map, everything shaded GREEN qualifies for USDA Home Loans.Finance Home Loan Aadhar Housing Finance Ltd is leading housing loan finance company in india. ahfl offers hassle free home loan, house loan or housing loan for low income segment at best interest rates. Apply Now!

. for a USDA loan? Anyone can use this program, as long as their income is sufficient to carry the house payment, but not too high based on USDA tables for the county the house is in. How much.

USDA Income Limits and Requirements in Florida. Another challenge to qualify for a USDA Loan in Florida are the income restrictions and debt-to-income ratio requirements. Income. USDA loans in Florida count the entire HOUSEHOLD’S income when determining if you’re eligible.

USDA loan income requirements are dependent upon the area in which an applicant wishes to purchase a home, as well as the number of people present in the household. Specifically, income requirements vary-the federal executive department’s website provides a complete outline of USDA loan income requirements.

USDA Rural Development loans are geared more towards lower/moderate income households. In most lower costs states, the 502 Guaranteed housing income cap for a standard family of 1-4 is $78,250. Higher costs states like California, Florida, Colorado, etc will have limits about 10-20K per year higher.

. no down payment and generally have less stringent credit and income requirements than those of a conventional loan. They also offer the opportunity for no monthly mortgage insurance. USDA Loans:.

. no down payment and generally have less stringent credit and income requirements than those of a conventional loan. They also offer the opportunity for no monthly mortgage insurance. USDA Loans:.

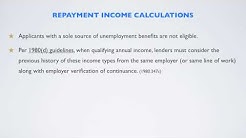

Usually, usda loan requires verified primary sources of income for a 24-month period to confirm loan approval. Alternate documentation is permitted in place of FNMA Form 1005. Alternate documentation must include: two years W-2’s, 30 days paystubs with year-to-date information, and a Processor’s Certification of Employment.

To qualify for the program, applicants must own their home, and fall within Rural Development’s income guidelines. by visiting USDA’s web site at.

Income Requirements – The USDA Loan ‘Sweet Spot’ USDA mortgages are unique in that they have minimum income requirements as well as maximum income limits that borrowers must meet. Simply put, there is a ‘sweet spot’ in between the lower and upper limits applicant’s must fall between.

Fannie Mae Grants Housing Development Finance While the current affordable housing obligation process for suburban communities in New Jersey has caused a stir statewide, the New Jersey Housing and Mortgage Finance Agency described. to aid in.Fannie Mae recently announced 3% down payment mortgages to help first-time homebuyers who can’t afford a large down payment but would otherwise qualify for a mortgage. First-time homebuyers interested in this option should ask their lender about the program and discuss the eligibility requirements, including underwriting, income documentation.

USDA Loan Requirements. To qualify for a USDA loan the requirements are as follows: The property to be financed should be located in one of the USDA designated rural areas. If you have confusions you can take help from the Federal Home Loan Centres Counsellors to determine whether the property is eligible or not.

Fha Housing Guidelines The FHA buyer will pay for the appraisal upfront before closing. The average FHA appraisal costs is between $300-$500 according to the uniform residential appraisal report (urar). If you’re applying for an FHA streamline refinance the FHA guidelines do not require a home appraisal. Main factors that affect the cost of an FHA appraisal